- Markets

- News

Much has been said about the recent crisis in the UK, with many in agreement that Liz Truss is to blame.

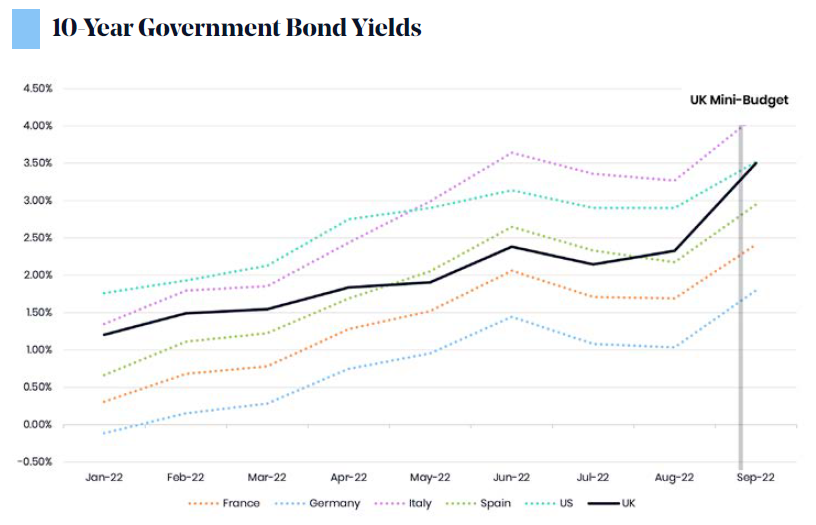

While this may be partially true, people seem to be missing the fact that 80% of the surge in gilt yields actually happened before the ‘mini-budget’ saga. More importantly, an almost identical surge in yields occurred across much of the Eurozone and the United States at the same time, which looks to be too much of a coincidence.

Much has been said about the recent crisis in the UK, with many in agreement that Liz Truss is to blame. While this may be partially true, people seem to be missing the fact that 80% of the surge in gilt yields actually happened before the ‘mini-budget’ saga. More importantly, an almost identical surge in yields occurred across much of the Eurozone and the United States at the same time, which looks to be too much of a coincidence.

Source: Organisation for Economic Co-operation and Development (OECD). Long-term interest rates from January 2022 to September 2022.

Clearly, inflation and rising interest rates (and the fear of further increases) should be the main immediate culprit, whilst these events in the UK show that an erosion of investor confidence, coupled with inflationary fears and high debt levels, can, even in developed markets, potentially lead to concerns of a sovereign debt crisis, and escalate quickly.

As investors, we should not just look in the rear-view mirror, but also watch out for what might unfold. No one is talking about sovereign debt pressures in the United States yet – any Fed talks are limited to the question of whether the Fed is willing to accept a recession or a stock market drop.

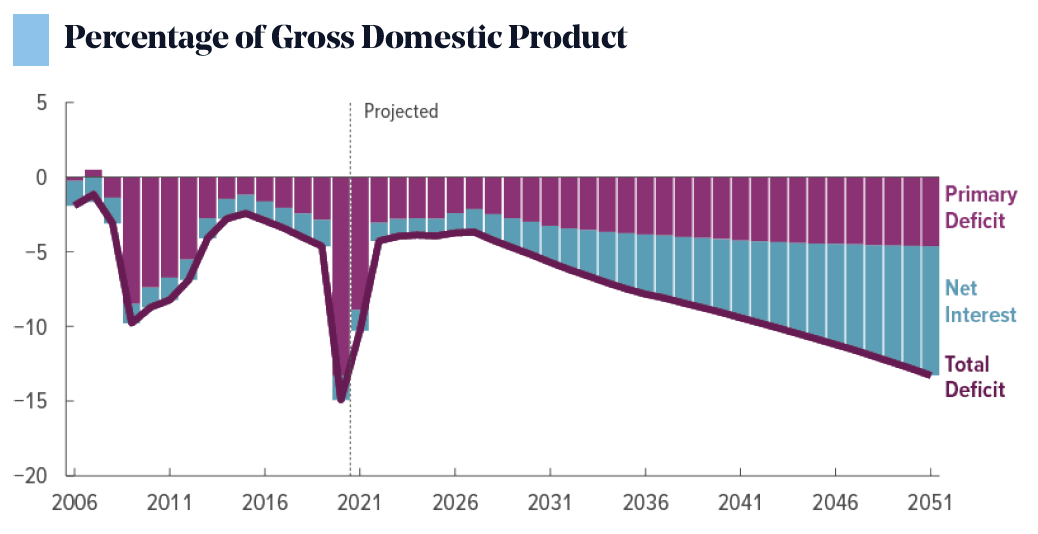

The US Congressional Budget Office (CBO) published a report in March 2021 (The 2021 Long-Term Budget Outlook), carrying a chart illustrating the concern about how rising interest payments are likely to expand the budget deficit to potentially unsustainable levels:

Source: https://www.cbo.gov/publication/56977

What is particularly noteworthy about these interest rate assumptions on which this projection was based can be highlighted in the report as follows:

“The agency expects the interest rate on 10-year Treasury note to average 1.6 percent over the 2021-2025 period and 3.0% over the 2026-2031 period. After 2031, the interest rate on 10-year Treasury notes is projected to rise steadily, reaching 4.9% by 2051.”

Yet here we are in 2022, with 10-year treasury yields at 4%, and with market expectations of a 4.9% Fed terminal rate materializing shortly.

If inflation really is to be addressed more seriously, there should arguably be more focus on budget deficits to be brought under better control. This was suggested prominently by former Fed Chairman Alan Greenspan in February 2020 (which was pre-Covid, pre-Ukraine/Russia conflict etc.!), stating that “unless we bring those extraordinary budget deficits under control, history tells us there is going to be a much more rapid rate of price increases than we have seen”.

With this clearly not happening, concern about the sustainability of such debt may grow soon, and the Fed may have to cave against this backdrop, even if inflation remained high. Surely, any admission of major Western central banks having to pause or give up the inflationary fight entirely would be rather big news, potentially leading to sharp asset price reversals.

Just like Singapore successfully launched into ‘living with the virus’, Japan today isn’t even trying to pretend to want to fight inflation with their sovereign debt at far higher levels already. The Bank of Japan seems content to simply ‘live with inflation’, since corporate profitability is sound, and the government is encouraging wage growth and incentivising investors to move cash holdings into equities. The Japanese market might accordingly be one of the first where inflation risk is recognised by the public as unavoidable, prompting savers to deal with it by reallocating their historically high cash holdings to anything inflation-proof, such as property and equities. This change of mindset can take some time to unfold after long deflation and may take some time for investors globally to follow as well.

I shared with Bloomberg last week that with investor pessimism and fear at high levels now, it is important to not be swayed through all the ups and downs. Given all the uncertainty and confusing with news headlines changing daily, investors should continue focusing on the longer term picture.

This article is provided for informational purposes only. It should not be relied upon as financial advice and it does not constitute a recommendation, an offer or a solicitation. No responsibility can be accepted for any loss arising from action taken or refrained from based on this publication. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted.

The value of an investment will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

Most recent articles