- News

At a glance

- H1 2023 saw strong returns from NASDAQ, led by the “Magnificent 7”

- Opportunities exist in other areas which form carefully constructed, diversified portfolios

- Interest rate hikes across major economies have brought the “new normal”, presenting attractive returns without the need to take as much risk as the last decade and half – while distressed opportunities may be on the rise

- The key to investing for the long term is to keep fully invested (except for pre-defined liquidity needs)

The last quarter finally felt like a sigh of relief, as some more positive news filed in after war, inflation and banking sector tumult. US once again managed to sidestep its debt ceiling crisis; fears of a deep recession appear to be receding; US consumer prices rose a modest 3% in the 12 months to June compared with a 9.1% last June1, fuelling hopes that the Fed’s monetary tightening might be nearing its end.

2022’s year of pain for tech stocks also appears to have ended. Chipmaker Nvidia saw its market capitalisation break $1 trillion for the first time, while Apple, at one point, reached a value of over $3 trillion. The performance of these technology giants helped drive the NASDAQ 100 up 6% last quarter. Overall, the index’s growth for the first half of the year reached a four-decade high of over 30%2.

While all this sounds like good news for investors, the rise of these extremely valuable tech companies also has the potential to distort an investment portfolio. The “Magnificent 7” - Apple, Microsoft, Alphabet, Amazon, Meta, Nvidia and Tesla – accounts for 55% of the NASDAQ 1003, triggering a special rebalance in NASDAQ 100 this month that has only ever happened twice previously in its 52-year history.

This is due to concentration risk. A passive fund tracking the above index will likely now have a large amount invested in a few companies from a relatively similar background. We saw in 2022 that technology shares do not always go up. If the sector goes through another downturn, that passive fund will likely follow. This is why we maintain our belief in the importance of diversification across sectors and regions. Our portfolios are thoughtfully constructed to balance exposure to these high-growth companies with investments in other promising opportunities.

Japan is one of these. I talked about the attractiveness of Japan in both of my quarterly updates in H2 2022 to explain why we continued to hold Japan – when Japan was perhaps overlooked by most due to its decade and half long of relative underperformance. Amidst endorsement from the likes of the oracle of Omaha – Mr Buffet himself, MSCI Japan grew by 13%4 in H1 2023. This is a great example of the importance of avoiding “rear-view mirror” investing (also known as the “recency bias” trap) – as the relative attractiveness of Japan’s valuation last year has more or less faded since this year’s rally.

The “new normal”

With successive hikes bringing interest rates to levels we’ve not seen for over a decade and a steepening yield curve, this “new normal”, coupled with the unusual sell-off in 2022 of the secure sovereign and investment grade bonds, brought attractive opportunities for us to move into higher quality credits at lower costs, thereby allowing us to achieve better risk-adjusted return as well as reaping the benefit of the asset class as a great diversifier within our portfolios.

We have reduced, but retained some of the inflation-linked bond exposures that saw us through the last two years of high inflation, to protect our portfolios from any potential surprise uptick in inflation.

We have also reduced, but retained some of our high-yield exposures, as we believe distressed opportunities may be on the rise, and some of our opportunistic investment strategies could be well-positioned to play offense.

Market calls

Through the volatile 2022 and a tentative first half of 2023, I have talked to many clients who expressed that it feels like fixed deposit are a better, safe haven to place their assets.

To which I give you two exhibits.

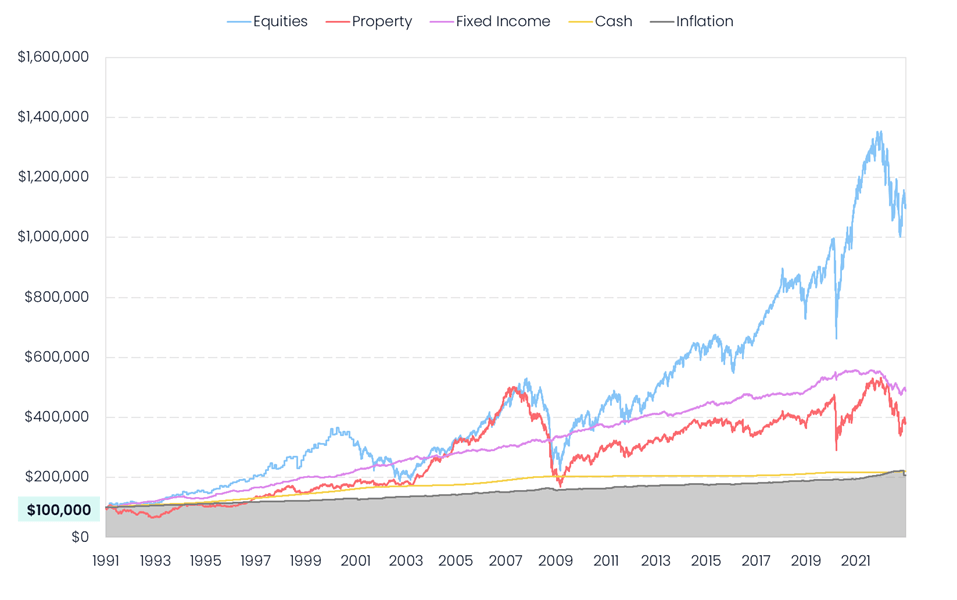

Exhibit 1. Despite the short-term fluctuations caused by market disruptions, over the longer term cash (including deposit) simply isn’t able to beat equities, fixed income or property (and even inflation – meaning you lose value by holding onto cash).

Source: Financial Express. Data from 1 January 1991 to 31 December 2022. All figures are calculated on a gross return basis which includes the reinvestment of income in USD. Equities are represented by the MSCI AC World Index. Fixed Income is represented by the Bloomberg Global Aggregate (Hedge USD) Index. Cash is represented by the FRB of New York United States Federal Funds Effective Rate. Property is represented by the IA Property Other sector average. Inflation is measured by the US Consumer Price Index.

The value of an investment in equities and shares may go up and down. This is different to the capital security typically associated with bank deposits held in cash.

Please be aware that past performance is not indicative of future performance.

Chart data as at 31 December 2022.

Exhibit 2. For those that believe it better to wait around for a bit and get back in the market when it’s less volatile / “on the up” – there’s a general saying in the investing circle that “the best five days in the market follows the worst five days in the market”. To put it in perspective, former Fidelity Magellan portfolio manager Peter Lynch (considered by many to be the greatest mutual fund manager of all-time), achieved a whopping 29.2% annualised return during his 13-year tenure; yet Lynch himself estimated that the average investor in his fund made only around 7% during the same period – while Fidelity estimated the average investor lost money. Why? In Lynch’s own words, “Whenever I would have a setback, the money would flow out of the fund through redemptions. Then when I got back on track it would flow back in, having missed the recovery.”

For exactly this reason, our portfolios are always fully invested (except for pre-defined liquidity needs) – we simply don’t see cash (including fixed deposits) as an asset class with attractive long-term risk-adjusted returns.

Investing can be as hard or as easy as you make it. If we focus on the short term, market will almost always seem “more volatile” than one can stomach; but if we focus into the longer-term horizon where our goals are, the ride will feel a lot steadier.

Past performance is not indicative of future performance.

The value of an investment with St. James's Place will be directly linked to the performance of the funds you select, and the value can therefore go down as well as up. You may get back less than you invested.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

1 U.S. Bureau of Labor Statistics

2 Financial Express. Total returns measured in USD.

3 Yahoo Finance.

4 Financial Express. Total returns measured in USD.

Most recent articles