- News

2022 was a challenging year for financial markets. Globally, the MSCI All Country World Index of stocks lost around a fifth of its value over the year measured in US Dollars and Fixed Interest assets failed to withstand their traditional stabilising role during volatile markets.

At a glance

- 2022 was a challenging year for financial markets

- History shows that the upside potential in the subsequent year is high

- We see long-term opportunities in the attractive valuations

- In times like this, it is even more important to spend time in the market, instead of trying to time the market

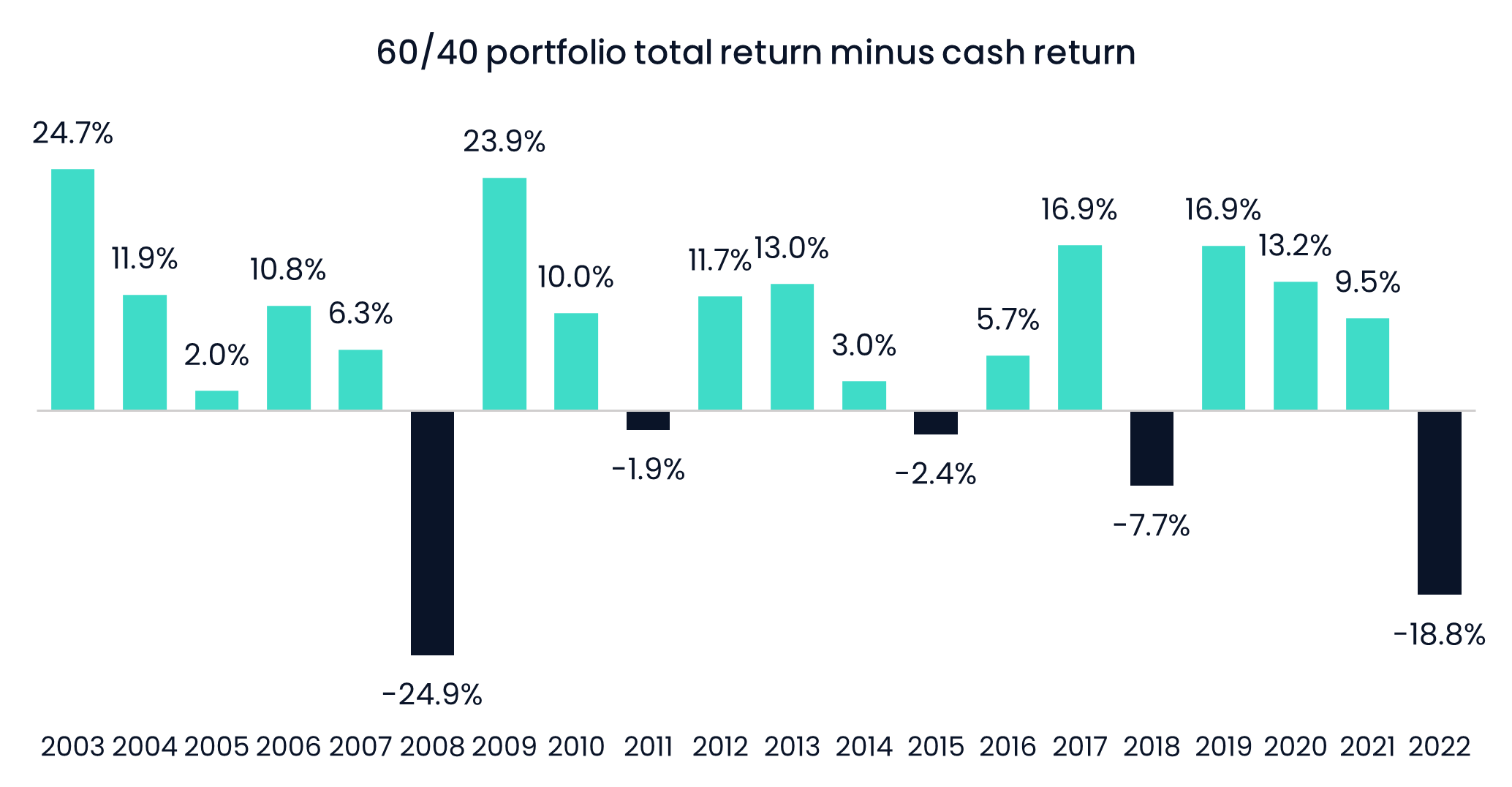

This combination meant that a 60/40 portfolio (used as a standard “benchmark” for traditional multi-assets) has underperformed cash in 2022 – and this has happened just 5 times in the last 20 years, with the worst underperformance the Global Financial Crisis (GFC) in 2008 and 2022 being the second worst. Yet, for every single one of the past 4 cases, the portfolio significantly outperformed cash in the subsequent year.

Source: FinXL. Performance figures are total returns measured in USD. Cash is represented by ICE BofA 0-3 Month US Treasury Bill. 60/40 portfolio is represented by 60% in MSCI ACWI and 40% in Bloomberg Global Aggregate.

Taking the asset classes in turn. On fixed interest, as we find ourselves in a higher interest rate environment today - though painful for our non-fixed rate mortgages - we do also have more opportunities to find yield – while companies' balance sheets remain strong. (You may find it interesting to listen to the recent interview with Oaktree’s David Rosenberg here covering the risks and opportunities in high-yield bonds.)

On equities, we see similar opportunities. In 2021, elated sentiment appeared to have driven the increase in stock markets as employment figures and online retail sales seem to have performed better than expected despite continued COVID-19 restrictions. In direct contrast to 2022, macroeconomic and geopolitical fears seemed to be the primary driver of global equity markets throughout the year. Valuations are looking attractive, though valuation spreads remain wide across all regions, this gives active managers the platform to find the best opportunities. While the market was rather jumpy around the prospects of a recession, based on history, we tend to see the five-year period following the start of a recession to be a good entry point for stocks in general. This is generally beneficial to our clients, who we help to invest for the longer term.

For our portfolios, the St. James’s Place Asia Investment Committee has considered at length the value vs growth cycles and roles of style factors within a portfolio. Over the longer term, we found that each investing style has shown persistent excess returns not explained by assuming the additional risk — these premia are a function of economic and / or behavioural drivers instead. Hence, given the cyclicality of style premia, this reiterates the need for style diversification. In particular, we have fine-tuned investment managers and investment styles exposure in a number of our portfolios, with recent events demonstrating the importance of balance between growth, quality and value style investing, an appropriate blend of which is the ethos of SJP’s investment beliefs.

Japan has also prompted a debate within the SJP Asia Investment Committee. The market has stood out as one of the weakest performers in recent years — troubled by a prolonged stagnation and low interest rate environment that even Abenomics couldn’t quite seem to shake. However, it has also traditionally been a good diversifier against global equities markets for the longer-term approach Japanese investors tend to take. It was interesting for us to note that global investors have been net sellers of Japanese equities, despite the backdrop of strong earnings per share (EPS) figures and improved margins in recent years. Coupled with a weak yen, some of our Fund Managers believe that Japan is at its most cost-competitive since the early 1970s. With these, we have decided to retain our Japan exposure to ensure we can participate on the upside.

Time in the market

If 2022 proved us anything, it’s that short-term events can be unpredictable.

The old adage of time in the market not timing the market remains the golden rule of investing. Countless variables can cause short-term fluctuations in valuations, and it is impossible to accurately predict them with any regularity.

And this is where long-term thinking can also really come in handy. Yes, it is hard to see the end of the tunnel now, but generally, it is better to buy low and sell high. If you exit now, selling could see you miss any bounce back in prices.

Let’s revisit the October of 2007, when markets started going on a downward spiral in the face of the looming GFC. By September 2009, global markets, represented by MSCI ACWI, had plummeted by close to 60%. To see the markets fall for a prolonged time can indeed be frightening for investors, but if you take a step back and stick to the fundamentals of investing, it will help you to stay on track — 10 years down, your portfolio would have rebounded and been rewarded with a further 54% positive return.

Besides, inflation appears to be easing, which may give central banks some wiggle room to slow the rate of interest rate rises. This trend suggests some positivity may lie ahead in 2023. If inflation was to continue to temper, and banks were to pause their rate hikes, history suggests there may be an opportunity for high-quality corporate bonds.

Despite ongoing issues with COVID-19, confidence is mounting that the Chinese economy might begin to recover in the coming year. Europe has also progressed in weaning itself off Russian energy, and the MSCI Europe ex UK rose over 4% in Q4.

Without doubt, the road immediately ahead looks difficult. However, right now plenty of good quality companies are seeing their values suppressed by wider market forces. I am confident our fund managers are well placed to identify these companies and take advantage of the more reasonable price and deliver better returns to you. In fact, we are seeing both our fixed interest and equity managers pointing to an environment where a reduction in cheap central bank funding amidst higher interest rates will show the value of detailed due diligence with more positive stock-picking and bond-picking conditions than witnessed in the past decade.

By making sensible decisions now, we can make sure we’re set up for long-term success.

Please be aware past performance is not indicative of future performance.

The value of an investment with St. James’s Place may fall as well as rise. You may get back less than you invested.

An investment in equities and shares will not provide the security of capital associated with a deposit account with a bank or building society.

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Most recent articles