The quick read

- The G7 summit is seen as a crucial event in the lead up to COP26 – the global climate conference taking place in Glasgow this November.

- St. James's Place has joined global investors in signing a letter that urges governments to strengthen policies which can accelerate investment towards the net-zero transition.

- We believe responsible investing has a huge role to play in shaping a better world and building a sustainable future.

- News

- Investing

St. James’s Place joins global investors' call to governments to step up climate response ahead of G7 summit.

World leaders will gather in Cornwall on Friday for the G7 summit. With the backdrop of a pandemic recovery, the event is likely to have a packed agenda including global vaccine rollouts, economic recovery plans and climate change.

The G7 summit is also seen as a crucial event in the lead up to COP26 – the global climate conference taking place in Glasgow this November. The conference is expected to review progress towards global warming targets set out in the 2015 Paris Agreement.

Earlier this year, members of G7 reaffirmed their commitments for tackling the climate crisis, with both the UK and US government setting new interim emissions targets for 2030. Evidence suggests that targets such as these are beginning to have an influence on the decisions of businesses, communities and even investors.

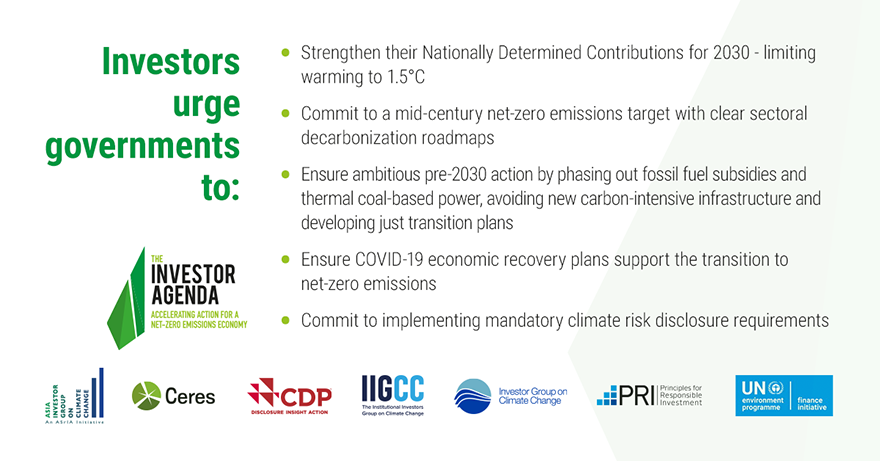

“We believe that those [countries] who set ambitious targets in line with achieving net-zero emissions, and implement consistent national climate policies in the short-to-medium term, will become increasingly attractive investment destinations. Countries that fail to do so will find themselves at a competitive disadvantage,” reads an open letter signed by 456 global investors with $41 trillion in assets.

With signatories including St. James’s Place, the letter urges governments to strengthen policies which can accelerate investment towards the net-zero transition.

Committed to climate

St. James’s Place is taking several urgent actions to tackle climate change. The most recent is a pledge to disclose our climate-related risks in 2021 – a year earlier than required by the UK’s green finance strategy. The move follows our first portfolio carbon emissions report released in 2020.

Our environmental strategy is underpinned by our commitment to the Principles for Responsible Investment (PRI) and Net-Zero Asset Owner Alliance (NZAOA), which aims to transition portfolios to net zero emissions by 2050.

St. James’s Place also recently became members of Climate Action 100+ and the Institutional Investors Group on Climate Change (IIGCC). Both investor groups aim to drive progress towards a net-zero future.

Our responsible investing page and TCFD report are designed to explore these subjects in more detail. Browse them and start finding out how you can benefit from the opportunities in a sustainable, low-carbon economy.

The value of an investment with St. James's Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

Some of the products and investment structures documented within this article will not be available to our clients in Asia. For information on the funds that are available please get in touch.

- The G7 summit is seen as a crucial event in the lead up to COP26 – the global climate conference taking place in Glasgow this November.

- St. James's Place has joined global investors in signing a letter that urges governments to strengthen policies which can accelerate investment towards the net-zero transition.

- We believe responsible investing has a huge role to play in shaping a better world and building a sustainable future.

Most recent articles