- Investing

The Fed has once again announced another round of rate hikes by half a percentage point recently, making it the central bank’s most aggressive move since the dotcom bubble days of 2000.

Against the backdrop of rising rates, mounting geopolitical tensions, skyrocketing inflation, and gyrating stock markets, it may seem like a recipe for disaster but investors should not lose sight of the forest for the trees.

While all the attention is on the Fed’s latest rate hikes, we have to remind ourselves that we currently stand at an interest rate of just 1%, with market expectations that it will likely rise to 2.95%1 by year-end. This still falls short significantly as compared to the latest US consumer price inflation (CPI) figure of 8.3%, implying that we remain in a significantly negative real interest rate environment, with no signs of inflationary pressures easing.

Moreover, looking at Europe, we saw the April CPI hitting 7.5%, implying an even wider gap between interest rates (currently still at negative 0.5%) and inflationary risks. Therefore, it still doesn’t seem the right time to become complacent about purchasing power loss risks brought on by inflation (e.g. the risk of holding cash), either.

In recent interviews with Bloomberg and RTHK, I talked about the relationship of equities and inflation, and more specifically about the prospects for Japanese and Chinese equities. As many investors are close to or have already sold off in these markets, this is often the time when good opportunities can be identified. Investors should also be aware that while equities as an asset class may appear increasingly scary amidst increased volatility, it can be an effective way of mitigating inflationary risks for long-term investors with an appropriate volatility tolerance. Most importantly, our approach remains to recommend being positioned in a globally diversified manner, but given the many questions we have received on these two aforementioned weaker markets, here are my thoughts on the specific factors that investors might not be fully conscious of that could aide potential rebounds.

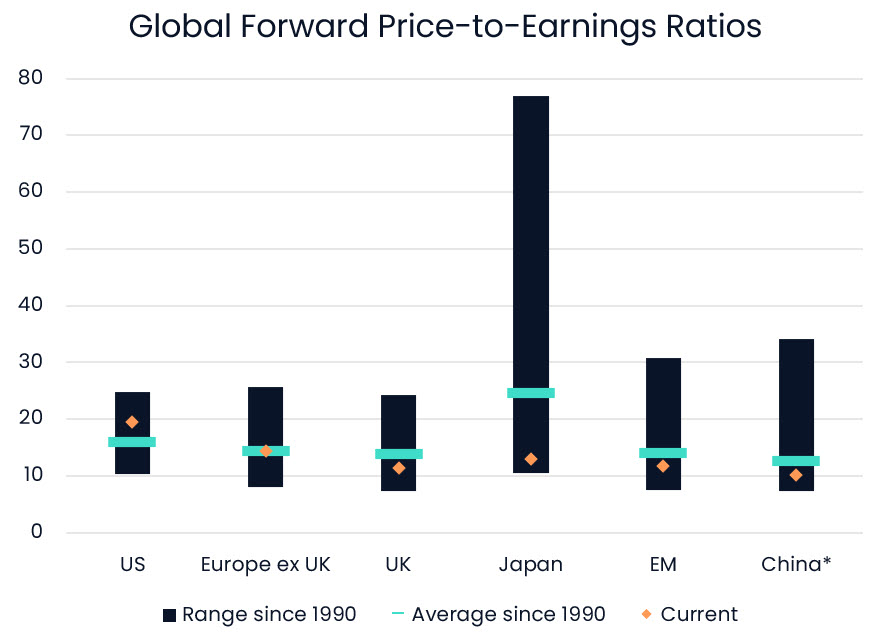

These markets are not the only ones that appear very reasonably priced, however. In fact, several others like the wider EM markets and the UK are currently trading below historical averages as well, as illustrated in the global forward price-to-earnings (P/E) ratios.

*Range and average for China is since 1996, due to data availability.

Source: IBES, MSCI, Refinitiv Datastream, Standard & Poor’s, J.P. Morgan Asset Management. MSCI indices are used for all regions / countries (due to data availability), except for the US, which is represented by S&P 500. Guide to the Markets – UK. Data as of 31 March 2022.

![]()

A lower forward P/E ratio means that investors are paying less for every dollar that the company will earn. It may indicate that a stock is relatively cheap, though it should not be viewed in isolation.

Value isn’t the only factor that leads to best future returns, other factors such as the assessment of individual companies’ growth prospects, return on capital, management etc. do come into play, which we and our managers carefully take into account and balance when composing portfolios.

For Japan, we should take note of:

- Low valuations (of Japanese equities, in Yen terms).

- RCEP (Regional Comprehensive Economic Partnership) benefits likely to be coming through shortly, if gradually, Japan might turn out to be the largest beneficiary (this seems to be largely forgotten by the market/media). RCEP is a free trade agreement among member states of the Association of Southeast Asian Nations, more commonly known as ASEAN.

- With signs of rising CPI, Japanese investors may increasingly start to look for inflation-proof investments (including local property and equities), shifting cash/bonds into markets.

- Teikoku Databank April survey shows 70% of retailers will raise prices this year. Japanese companies have held back on back price increases for a long time but now global inflationary pressures may provide the needed excuse for price hikes. Coupled with lower Yen (lower cost for exporters), it can provide impetus for earnings of Japanese shares.

For China, we should take note of:

- Valuations are depressed in terms of historic levels within China and relative to global averages; point of maximum pessimism might be reached following last year’s crackdowns/tightening and current Covid lockdowns.

- Government is generally set on stability and economic support now, in contrast to last year.

- Unlike the West, China is generally on a monetary/stimulus easing rather than tightening path. While significant outright interest rate cuts are difficult to pull off, in face of the US rate hikes and China’s preference for a reasonable degree of currency stability, massive tax cuts and infrastructure spending packages (exceeding Trump tax cuts and Biden infrastructure packages, respectively) and other stimulus measures have the potential to lend support.

This article is provided for informational purposes only. It should not be relied upon as financial advice and it does not constitute a recommendation, an offer or solicitation. No responsibility can be accepted for any loss arising from action taken or refrained from based on this publication. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted.

The value of an investment will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

An investment in equities and shares will not provide the security of capital associated with a deposit account with a bank or building society.

1 Bloomberg World Interest Rate Probability and Overnight Interest Swap Market Measures

Most recent articles