- Investing

Fund managers think a return to normality may shift the landscape for equities.

“The market does not turn when it sees the light at the end of the tunnel. It turns when all looks black, but just a subtle shade less black than the day before.”

As markets responded to the announcement of not one, but two vaccines to prevent COVID-19, the words of Jeremy Grantham, chief investment strategist at fund manager GMO, appear to have rung true.

While there are still many unknowns about the process of inoculating the global population – leaving the light at the end of the tunnel an incalculable distance away - the possibility of a return to normality in 2021 has injected markets with a welcome sense of optimism about the prospect of major economies making a full recovery next year.

The market fall in March affected some sectors more harshly than others, and its response to a COVID-19 vaccine has seen those same sectors have something of a renaissance. Share prices in the travel and energy sectors rose dramatically on the news, while the ‘stay at home’ stocks, such as Zoom and Netflix, fell.

If this pattern continues, the recovery in 2021 may have the potential to shake up the balance of power in global equity markets. But what does this mean for investors?

A full recovery?

A workable vaccine has the potential to shift the outlook for the world’s major economies from a recessionary environment to one of growth. This shift has made markets more bullish and ‘risk-on’, particularly towards stocks that have struggled for some time but may come back with a vengeance in 2021.

“In short, when investors are pessimistic about the virus and its economic fallout, they pile into companies either benefiting from the virus or whose prospects are, at a minimum, undiminished by the pandemic. Many of these companies have become very expensive because of their perceived safety,” explains Dan O’Keefe from Artisan Partners, co-managers of the St. James’s Place Global Value fund.

“But when signs of an economic rebound or the pandemic’s end surface, investors shift their attention to those stocks either left to the side because they lack sizzle or whose earnings have been devastated by the pandemic—in other words, many of our holdings,” he continues.

Over the last couple of weeks, the unloved ‘value’ stocks have started to pick up and outperform stay-at-home ‘growth’ companies.

| Oct 19 – Oct 20 | Oct 18 – Oct 19 | Oct 17 – Oct 18 | Oct 16 – Oct 17 | Oct 15 – Oct 16 | |

| S&P 500 | 9.17% | 12.20% | 10.92% | 12.97% | 31.34% |

| S&P 500 Value | -7.79% | 12.14% | 6.25% | 9.16% | 33.55% |

Source: Financial Express; data shown for Total Return indices. Past performance is not indicative of future performance.

This is significant for long-term equity market investors for several reasons. The last decade has been dominated by growth stocks, and a rotation – a shift in investor preference from growth to value – has been a long time coming.

“History has shown that once market sentiment starts to anticipate the end of a recession, value tends to stage a powerful and long-lasting rally,” confirms Pzena Investment Management, co-managers of the St. James’s Place Global Value fund.

“The expected improvement in the economy should prove highly constructive to the earnings and valuation of these industries,” adds Lew Sanders from Sanders Capital, another co-manager of the Global Value fund.

A rotation doesn’t mean that growth stocks will be abandoned. Sectors such as ecommerce and Big Tech “should continue to have stable long-term expansion because of strong secular trends,” notes Chris Iggo from AXA Investment Managers. Habits that we have adopted during lockdowns – including video-conferencing – are also likely to have longevity in a post-COVID world.

However, a wide-ranging economic recovery in 2021 might be the golden opportunity for value to ‘catch up’ with growth.

This has the potential to create a more balanced and widely distributed leadership in equity markets.

A rotation has the potential to balance out the over-valuation of growth stocks and the under-valuation of ‘value’ sectors, including industrials and financials: currently, just seven ‘growth’ companies comprise 27.6% of the S&P 500, whilst industrials and financials together are only 22.3%. A sustained rotation could change this – and the source of investor returns – quite significantly.

A dose of realism

Vaccine announcements by Pfizer, BioNTech, Moderna and Oxford University have been interspersed with news of rising case numbers and fresh lockdowns in the US and Europe.

It’s likely markets will continue to peak and trough as investors attempt to weigh the immediate challenges of COVID-19 with the optimism and progress around vaccine development.

But, keeping the long-term in mind, there’s evidence to suggest that fund managers have adopted a mindset of ‘when’ and not ‘if’ economic recovery really gets going.

The vast majority (91%) of managers expect the economy to be stronger in the next 12 months, while 66% believe that global growth is already in an early-cycle phase, meaning the recessionary period has ended, according to a recent survey of fund managers by Bank of America1.

As a result, fund managers’ cash holdings are at their lowest level since 2015 and optimism about global profit expectations is at its highest since 2002 – which bodes well for value investing2.

Don’t put all your vaccines in one basket

Just as governments have placed orders with several vaccine providers in the hope that one or two may prove viable, investors should also be looking to remain diversified - particularly if a rotation is on the cards.

This includes a diverse range of investment styles like value and growth, as well as exposure to a wide range of regions who may return to growth at different points next year as vaccines are slowly rolled out across the world, notes Chief Investment Officer Tom Beal.

"The development of effective vaccines against COVID-19 is promising indeed, and improves the outlook for investors as we head towards 2021. The recent rally in value stocks is a stark reminder how quickly sentiment in markets can change, and highlights the importance of having a blend of investment styles in your portfolio.”

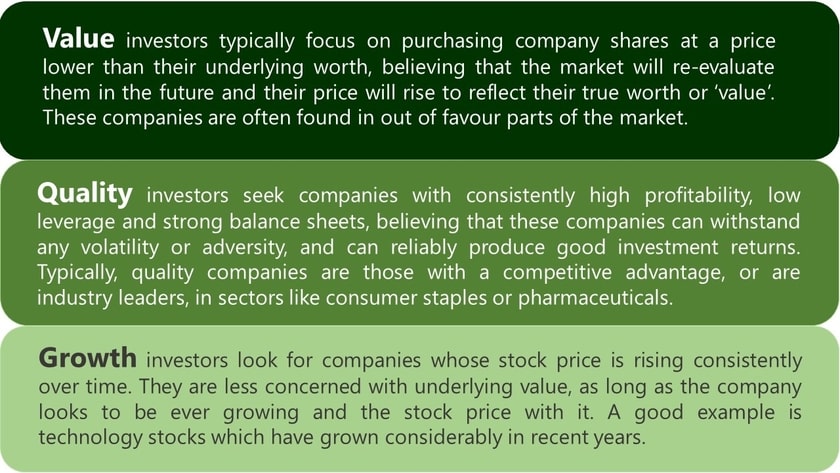

“Rather than trying to time rapid shifts in market sentiment as result of COVID trends, having a balance of exposure to ‘growth’, ‘quality’ and ‘value’ stocks diversify and smooths the return of your equity investments over the long-term.”

1,2 BofA Global Fund Manager Survey, Nov 20

Artisan, AXA, Pzena and Sanders Capital are fund managers for St. James’s Place.

Where the views and opinions of our fund managers have been quoted these are not necessarily held by St. James's Place Wealth Management.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and the value may fall as well as rise. You may get back less than the amount invested.

Some of the products and investment structures documented within this article will not be available to our clients in Asia. For information on the funds that are available please get in touch.

Most recent articles