- Investing

- News

- Markets

At a glance

- More than half of the world has participated or will be participating in elections this year, and the only certainty is that markets will be uncertain in the short term.

- Persistent inflation pressures will mean a more cautious approach to rate cuts by central banks, with ultra-low interest rates seen in the last decade unlikely to return.

- Investment success is best achieved by focusing on long-term goals and not speculating on market reactions to interest rates or political changes.

Markets, elections and long-term returns

After an initial dip in April, we saw equities recover over the rest of Q2, with several US exchanges hitting record highs over several sessions, powered by tech mega-caps, while the rest of the indices underperformed. Bonds have been much “duller”—spreads continued to grind tighter for most of this quarter, except for a fit of volatility in French bank and sovereign bonds after President Macron unexpectedly called for snap parliamentary elections.

By the end of 2024, more than 80 countries and more than half the world’s population would have been involved in an election. The outcome of many was uncertain – except perhaps the recent UK general election.

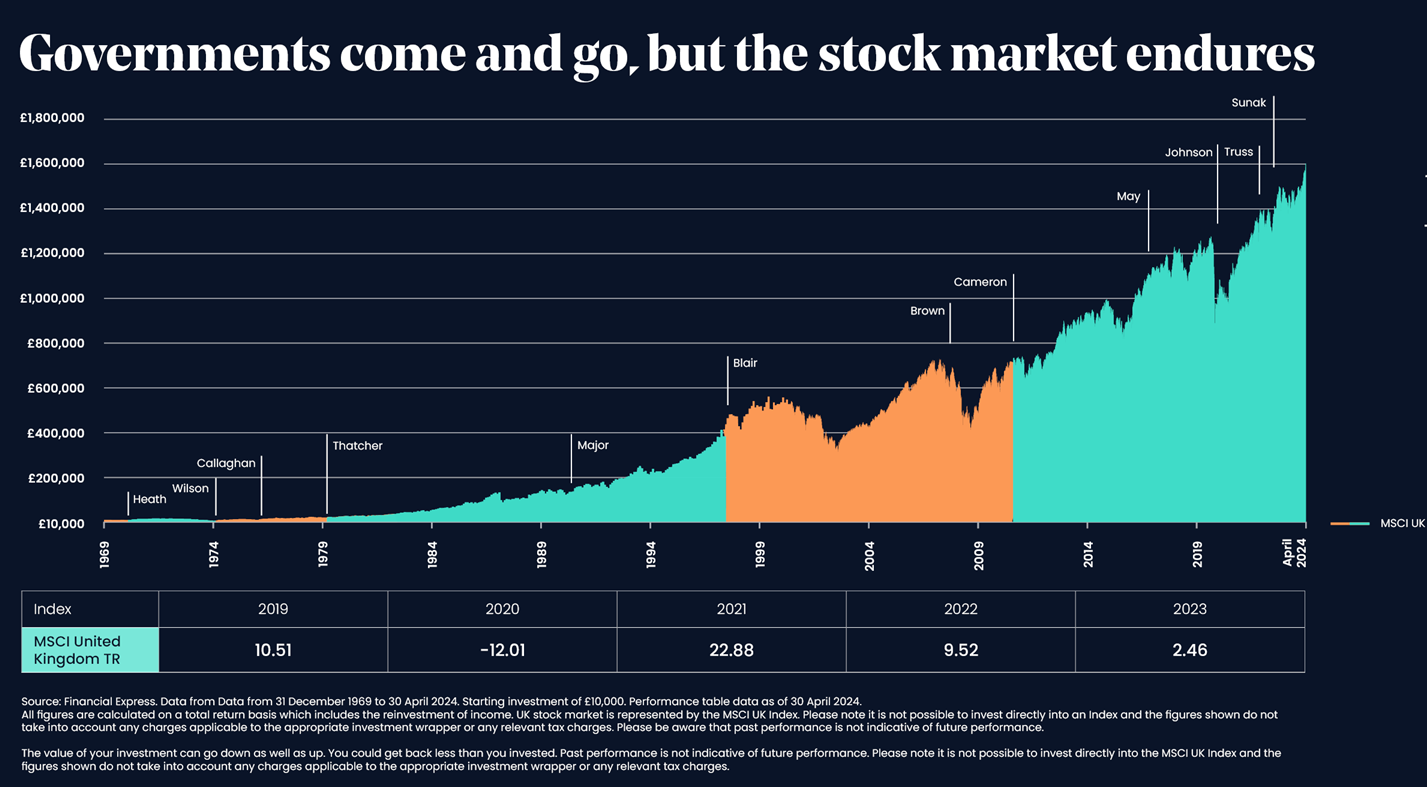

Over the longer term, our analysis of UK market performance data spanning the past ten UK elections from 1987 found no clear trends between election outcome and market performance, underscoring the importance of staying invested and not trying to time the market in response to short-term events. In our view, this principle largely applies to other markets as well.

Inflation and interest rates

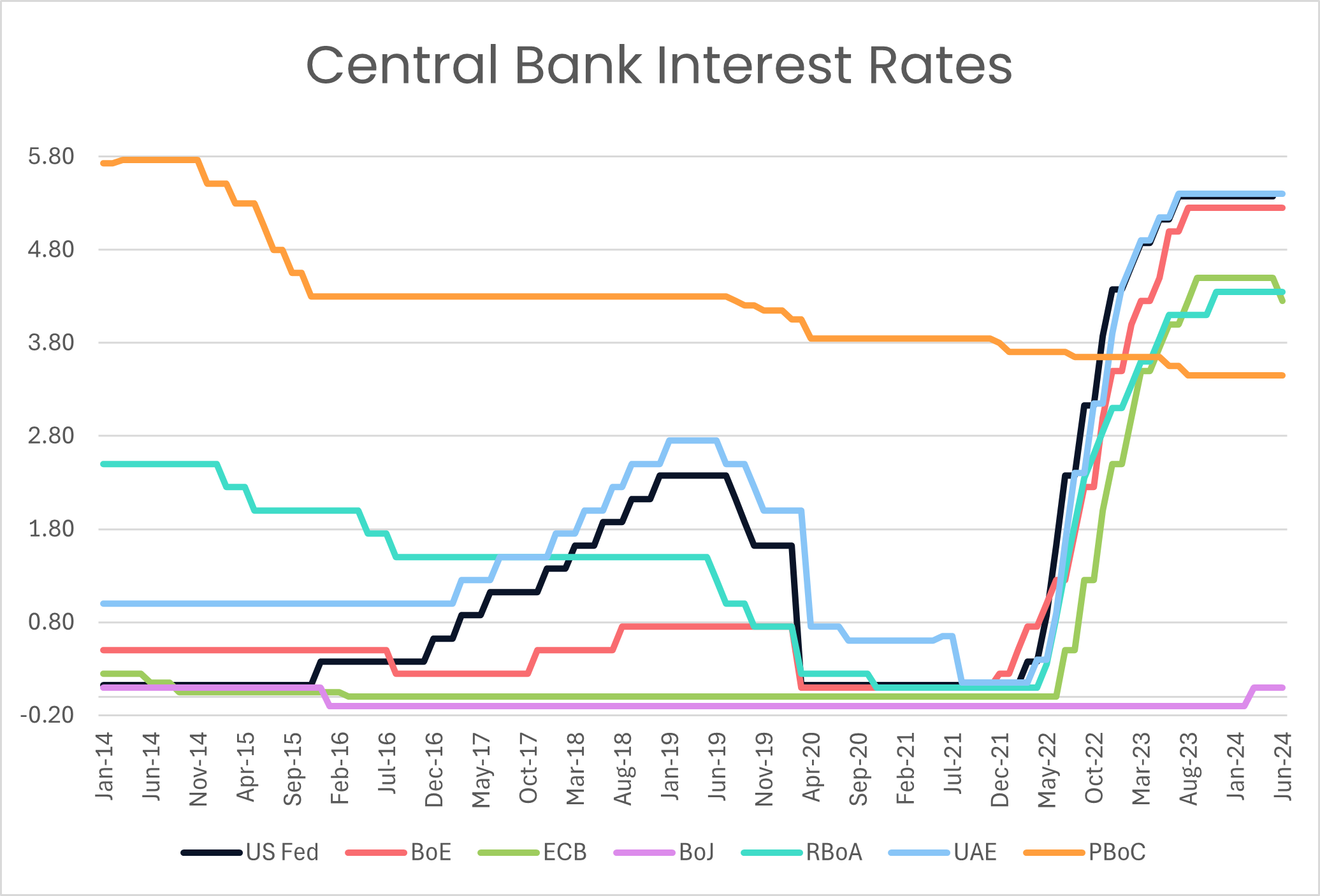

Modern monetary policy sets an inflation target of around 2% for most of the major central banks around the world, where their key lever is the setting of interest rates. Since 2021, supply shortages due to the Covid-19 pandemic combined with Russia’s invasion of Ukraine triggered inflationary pressures that had been dormant for years. Many central banks responded by raising interest rates over a quick succession.

For much of the last year, the market has been eagerly monitoring how quickly and easily central banks can reverse course. In June, Canada became the first country in the G7 to cut rates, with the European Central Bank opting to lower rates soon after. Progress has been slow for the US as inflation pressures have yet to be fully extinguished, second-round effects keep services inflation elevated and higher commodity prices are feeding through. The picture in Asia isn’t homogenous either, with the Bank of Japan raising interest rates for the first time in 17 years while China is experiencing deflation from weak domestic consumer consumption.

Sources: Global rates, Bank of Canada, European Central Bank, Bank of England, Federal Reserve Bank of New York, Reserve Bank of Australia, Central Bank of the UAE, 9 July 2024

Higher-for-longer – what does this mean for investors?

The most widely held view is that interest rates around the world’s major economies will decline from their current levels but settle at a level higher than before the pandemic. In other words, a return to near-zero interest rates seems very unlikely.

As an investor, adapting to this ‘new normal’ of higher rates will present challenges and opportunities.

Equities

Historically, elevated interest rates have been associated with higher, not lower, equity prices. This is because higher rates often come at a time of higher economic growth, which can benefit company profits. Moreover, firms with a competitive edge in the marketplace can typically pass through rising input costs to their customers in the form of higher prices charged for products and services delivered, thereby providing a degree of intrinsic inflationary protection to investors - a factor that easily gets overlooked but can be critical for long-term investment outcomes.

However, heavily indebted businesses may face increased financial pressure under higher interest rate conditions. In such environments, it is important to allocate to companies that are less sensitive to rates, such as those with strong balance sheets, low debt levels, and solid cash flows.

Bonds

Bonds are loans given to governments or companies, which they promise to pay back after an agreed term. The bond issuer also pays interest at a set rate, which determines the bond’s yield.

Interest rates have a big impact on bond yields. When interest rates are high, bonds come with higher yields because they need to be attractive enough for investors to buy them. As rates fall, the higher yields on existing bonds make them more attractive relative to newer-issued bonds.

More importantly, however, with higher yields in general, we believe that bonds can once again provide effective diversification, offering predictable and reasonable returns with less volatility than other investment assets.

Alternatives

Alternative investments, which can include assets such as commodities, private equity, and hedge funds, can offer several advantages such as lower correlation with standard asset classes, while certain types of alternatives, particularly commodities, can be effective hedges against inflation.

However, as bond yields become more attractive, the risk-adjusted returns of alternatives compared to what bonds are offering now should be evaluated carefully.

Cash

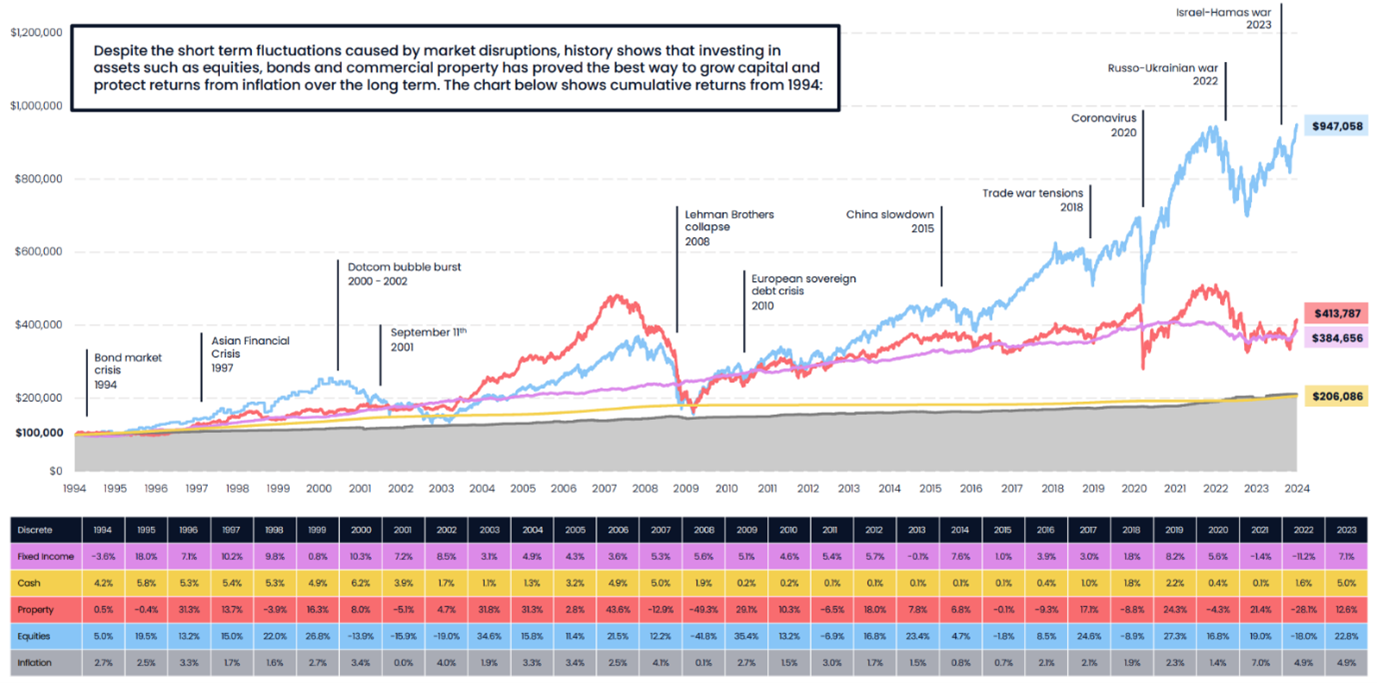

On the surface, cash may look attractive as interest rates are higher. However, as rates have increased in line with inflation, the value of cash will be eroded over time unless it produces a return that can outpace the effects of inflation. As the chart below shows, over the long term, cash generally delivers negative value after accounting for inflation.

Source: Financial Express. Data from 1 January 1994 to 31 December 2023. All figures are calculated on a gross return basis which includes the reinvestment of income in USD. Equities are represented by the MSCI AC World Index. Fixed Income is represented by the Bloomberg Global Aggregate (Hedge USD) Index. Cash is represented by the FRB of New York United States Federal Funds Effective Rate. Property is represented by the IA Property Other sector average. Inflation is measured by the US Consumer Price Index.

Given the constantly evolving political and economic conditions, forecasting market returns in the short term is inherently difficult and unpredictable. As such, it can be tempting for investors to try and "time the market" – e.g. wait for a particular event to occur before making an investment decision; however, history has shown – as the chart above – that this approach is often counterproductive over the long run. The best strategy is to stay the course with a disciplined, consistent investing approach. Rather than trying to predict the unpredictable, focus on regular, periodic contributions to your portfolio. This steady, unemotional approach may not feel as exciting, but it's proven to be the most reliable way to weather periods of volatility and uncertainty. By resisting the urge to react to short-term fluctuations, you'll position your investments for long-term growth, no matter what governments are in power, where interest rates are, or other external factors that may emerge. The only certainty is uncertainty - so your best move is to stick to a proven investing playbook.

Time in, not timing the market.

This document is for information only and should not be relied upon as financial advice. It does not constitute a recommendation, an offer or solicitation. No responsibility can be accepted for any loss arising from action taken or refrained from based on this publication. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted.

Past performance is not indicative of future performance. The value of an investment with St. James’s Place will be The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

An investment in equities will not provide the security of capital associated with a deposit account with a bank.

Most recent articles