- Investing

- News

Welcome to the latest issue of our quarterly CIO insights.

The new year always begins with a burst of joy - family gatherings, festive meals, and the warmth of celebration. Then, almost inevitably, comes the lurgy: the sniffles, the coughs, even a high fever for some – a reminder that highs are often followed by dips. But just as quickly, we get through it, shake it off, and find ourselves on the up again - renewed, re energised, and ready to hit fresh goals. Markets remind me of the same truth: ups and downs are inevitable. Surges and corrections aren’t punishment; with discipline, they’re progress. The celebrations give us energy, the setbacks give us perspective, and the recovery reminds us that growth is never a straight line, but a rhythm we learn to embrace.

Volatility – a smoother ride than usual

So, what can we take from 2025? If we look at volatility, an inevitable feature of markets and investing, earlier in the year investors saw sharp spikes (we referenced them as fat tails at the start of 2025) driven by factors from global trade tensions (tariffs in particular) to US fiscal debates, to ongoing geopolitical risks such as the conflict in Ukraine and in the Middle East. Yet recently markets have been calmer, with volatility levels remarkably low, including the initial reaction to developments in Venezuela. Does this mean calmer times are ahead for investors? Can we feel confident that the time of extreme volatility is passing? There are certainly reasons for cautious optimism and signs that many economies have weathered the headwinds of 2025 well. In the US, the Federal Reserve cut interest rates for the third month in a row in December. Lower interest rates, alongside a weaker dollar (as I discussed in the October CIO newsletter) are providing additional support for growth and the US economy is generally looking more resilient. While unemployment reached 4.6% in November, it does not seem to be accelerating further. This is consistent; across most major developed economies labour markets have cooled without triggering a sharp rise in unemployment – this is an encouraging sign of underlying resilience. Meanwhile, the UK fiscal policy remains tight, but the UK economy is still expected to grow at a steady pace next year, helped by looser monetary policy.

Could there be artificial intelligence (AI) bubbles ahead?

One of the most common questions I get asked by investors, clients and journalists alike is whether we are on the verge of a market bubble – in particular, an AI-fuelled bubble. Market performance in 2025 was once again dominated by the Magnificent 7 technology companies, with AI driving much of the growth. There has also been vast investment into AI infrastructure which has led to concern among some investors about how sustainable this is. While AI will likely continue to dominate much of the news flow, investors will need to see how widely its benefits can extend across other market sectors if they are to remain confident. Taking a more optimistic view on the other hand, while valuations of many US tech companies may be at record highs - i.e. these companies look expensive - a closer look at earnings doesn’t back up fears around a potential bubble. The S&P 500 has seen strong earnings growth over the course of the year and the fundamentals still look attractive, not least because of the resilience of the US economy. That said, we know valuations are the key driver of medium to long-term returns, therefore while US equities remain a cornerstone of global markets, and we continue to see strong opportunities there, we believe a much smaller allocation than the market weight is sensible in our portfolios.

Correction on the cards?

In December, major global markets from the US to Europe to Japan all hit new highs, led by the Hang Seng Index in Hong Kong and the TSX in Canada. This has been primarily fuelled by resilient earnings and the Federal Reserve’s interest rate cuts. Valuations in some areas already imply overly optimistic outcomes and there are significant valuation disparities across different asset classes. While we believe we are not yet in bubble territory, with markets at record highs, we have to remain alert that market corrections are inevitable.

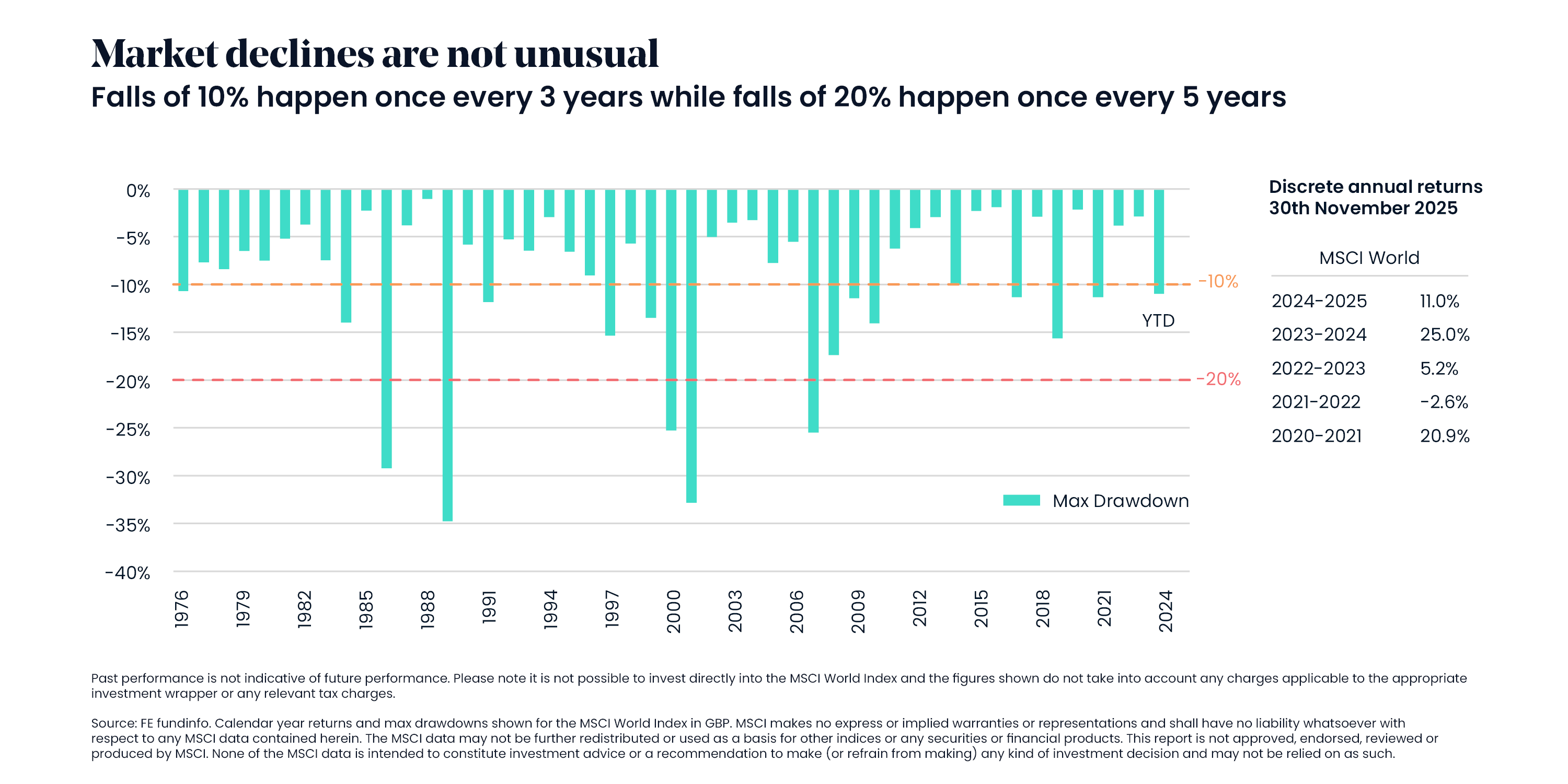

“Market corrections” might sound dramatic, but they occur more often than many realise. A market correction is generally defined as the market falling 10% or more from a market high – essentially a 10% drop from peak to trough. When the fall reaches 20% or more, it is considered a bear market. As the chart below shows, such declines are not unusual: corrections (decline of 10%) happen once every three years on average, while 20% drops occur roughly every five years. In short, corrections are a normal part of market behaviour.

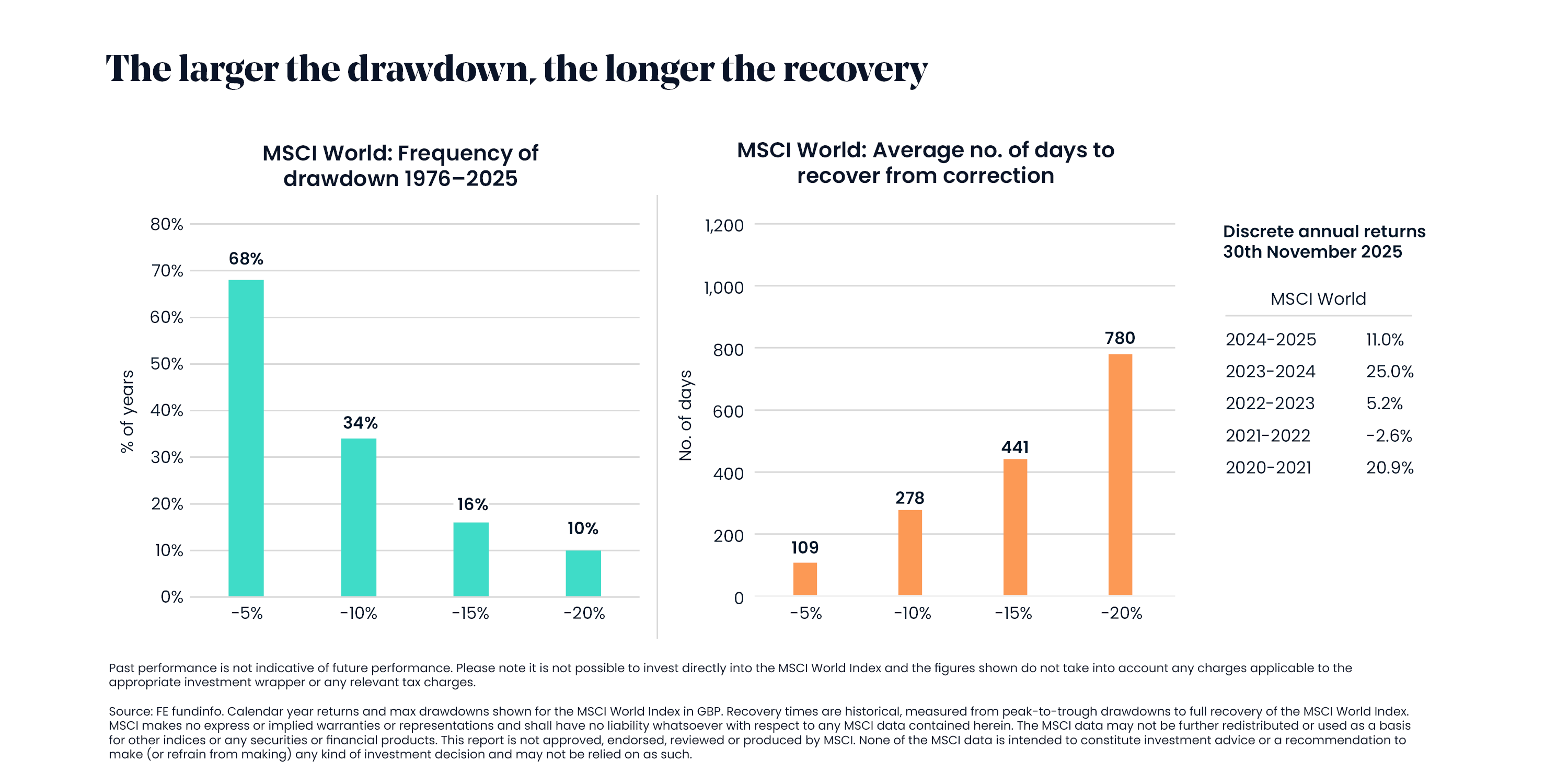

In fact, the chance of markets falling by at least 5% a year is more common than not. The chart below shows that between 1976 – 2025 the chance of an annual market decline – or drawdown – of at least 5% stood at nearly 70% based on MSCI World data.

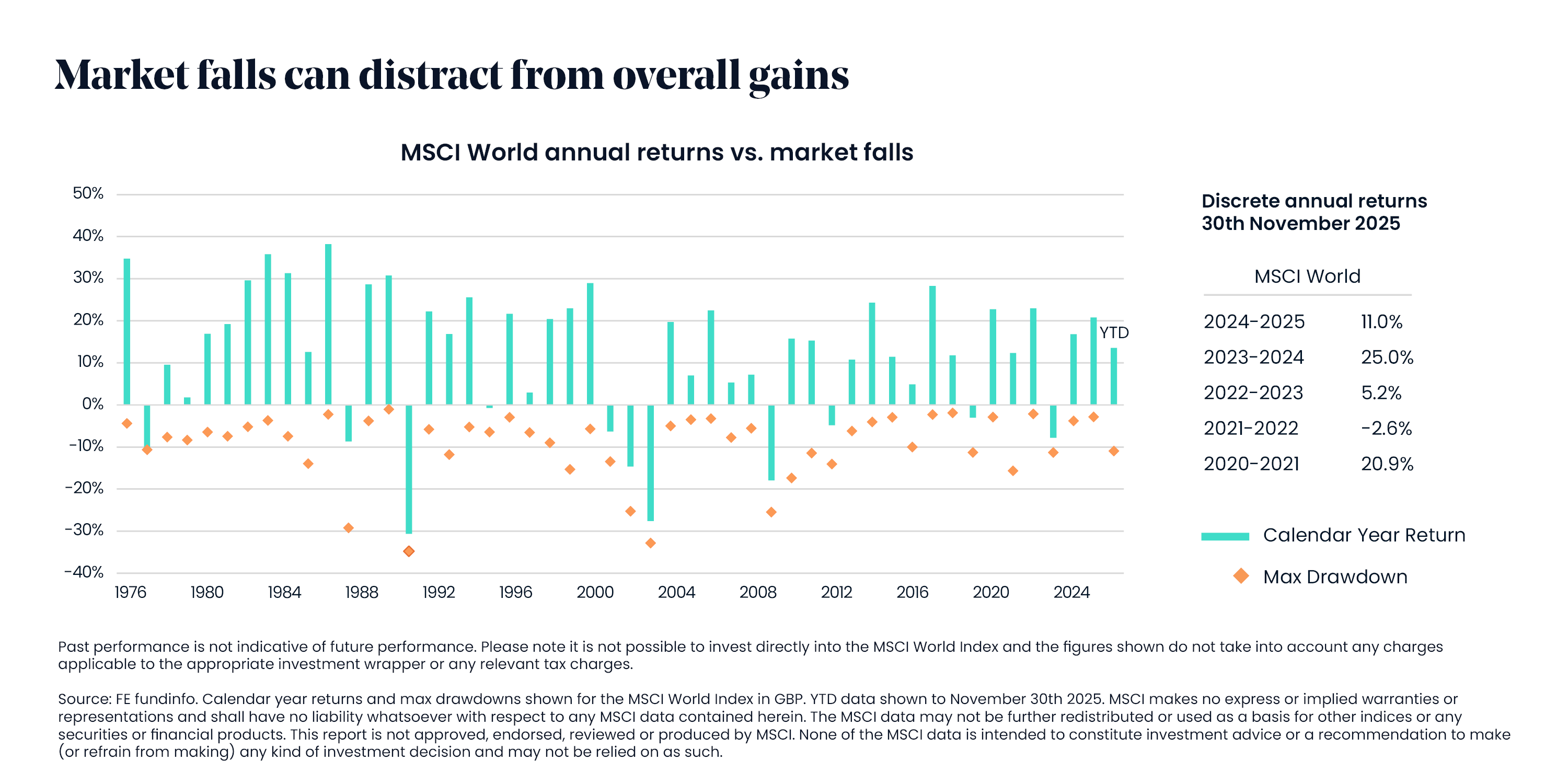

The chart also shows that in most cases, the larger the correction, the longer it can take for markets to recover. This underlines the importance of taking a longer-term approach rather than rushing to make decisions in response to short-term movements. Interestingly, history also shows that some of the market’s best days often occur immediately after its worst days - meaning that stepping aside during periods of volatility can risk missing out on the strongest rebounds. This is further compounded by that market falls tend to attract more attention among investors, distracting from the overall gains made over the course of the year and longer term, as the chart below shows. Even a 10% fall in the market is typically made back in less than a year.

Corrections can in fact bring benefits for investors. By taking some hot air out of the market, it can bring assets more in line with their underlying value. Removing the speculation allows people to see more clearly. It also gives space for investors to focus on the fundamentals of companies – earnings and real profitability – rather than being carried away on a wave of blind optimism. And of course, market corrections can also offer the opportunity for investors to invest in high quality assets at lower prices.

Navigating drawdowns

Market corrections are not only frequent, but they are also inevitable for long-term investors. Managing a portfolio through market peaks and troughs requires discipline and commitment and an understanding that periods of volatility are a part of investing for the long term. The key is to be prepared for the ups and downs and follow the basic rules – stay invested, stay diversified and do not fear the volatility. Market ups and downs create new opportunities for disciplined investors. Our investment team remains vigilant in identifying these, and I encourage you to stay attentive as well. It is often in uncertain periods where some of the most compelling opportunities emerge.

Conclusion

Market corrections are inevitable. When investment strategies lack consistency or discipline, they can magnify the impact of those shifts. Yet corrections themselves are not disasters – they are often the healthy reset that clears excess, restores balance, and allows markets to function more efficiently.

Please note that past performance is not an indicative of future performance, and the value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

The value of an investment in equities and shares may go up and down. You may get back less than the amount invested. This is different to the capital security typically associated with bank deposits held in cash.

This advertisement has not been reviewed by the Securities and Futures Commission, the Monetary Authority of Singapore, or the Dubai Financial Services Authority. This article is a general communication that is provided for informational purposes only. It should not be relied upon as financial advice, and it does not constitute a recommendation, an offer or solicitation. No responsibility can be accepted for any loss arising from action taken or refrained from based on this publication. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given, and no liability in respect of any error or omission is accepted.

Most recent articles