- News

- Investing

George Luckraft, manager of the St. James’s Place Diversified Income Fund since 2007, discusses his positive views about the UK equity market outlook and what this means for his investment strategy.

What are your thoughts on the market outlook after such a volatile year?

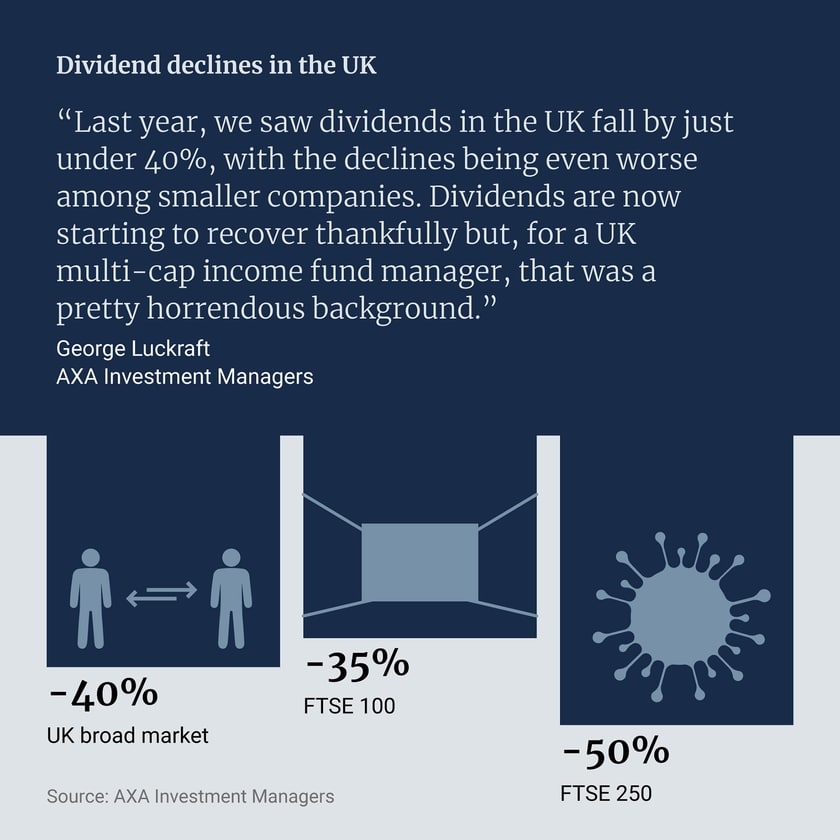

I think that certain areas of the market are priced for near perfection, which is always a source of concern. Many other areas, however, appear more modestly priced which is good news. It’s worth returning to what happened last year, where we saw dividends in the UK fall by just under 40%, with the declines being even worse among companies further down the market cap spectrum. Dividends are now starting to recover thankfully but, for me running a multi-cap income fund, that was a pretty horrendous background. If just over a year ago you had told me exactly what was going to happen, I would have probably said that the worst place to start would be with a portfolio like mine. I actually think the reverse is the case now.

I am quite optimistic about 2021 and what comes next. The UK market has been un-investible for some time to a lot of foreign investors. That is primarily because of the Brexit uncertainty, which has now gone. We now have more clarity about what the future trading environment looks like and we are starting to see international investors’ long held underweight position towards the UK start to reduce. That is reflected in the rather significant strength of sterling recently. This has been a headwind for the international earners within the market, but for domestic earners, it is positive because it helps to keep their costs down.

Why is the UK one of the only major markets that is not back at record highs?

This is in part due to the reluctance of overseas investors to buy UK assets because of Brexit uncertainty. But it is also to do with the structure of the market, with its large exposure to oil and gas. This time last year, this structural issue contributed to the UK’s underperformance. We ended up with a negative oil price and both BP and Shell were forced to cut their dividends significantly – this wasn’t a great backdrop for the UK indices. Now, with the oil price up about 20% year-on-year, the oil majors are generating lots of cash again and using it to pivot towards more sustainable, renewable sources of energy. So, the UK market looks a bit better again from that structural perspective.

The same applies to the UK’s exposure to the banking sector. This time last year, the banks were banned from paying dividends by the regulator. They are now just starting to return to dividends, albeit at much lower levels than they were in the past. These compositional issues have held back UK returns over the last twelve months, but they are now a cause of optimism.

Will Brexit make much difference over the long term and how have you positioned your fund with it in mind over the last few years?

The vote itself created some interesting opportunities. The UK housebuilders, for example, broadly halved in the aftermath of the vote and I bought a position in Bovis during that dislocation. Then we went through a long period of underperformance from domestic stocks, which presented the opportunity to enter stocks like DFS Furniture.

The problem was uncertainty – there was a prolonged period in which decisions were deferred, which is bad for business. Whatever the decision on Brexit, visibility was the important thing, because once you have it, you can work out what you want to do. Now, with more clarity, businesses can make decisions again, as can foreign investors.

When are you expecting a return to normality, and what will that look like for dividends?

I think it may take until 2022 or 2023 before dividends on the UK market recover to where they were before the pandemic. And I also think quite a lot of companies will operate under a different regime going forward – having seen the impact of the pandemic, they will model and plan for a similarly impactful event in the future. This means boards are going to be more conservative on balance sheets overall, and probably also more conservative on dividend cover.

Ultimately, this will likely represent a slight negative for the yield of the market, but it will also be a positive in that dividend income will be a lot safer, resilient and perhaps more highly valued.

How does the UK government pay for the pandemic response?

I think the important thing is to actually go and deliver growth. If governments can keep debt levels from rising too significantly in the future, borrowing requirements will reduce quite significantly, as long as we have economic growth. If you can get overall GDP growing significantly, the level of borrowing becomes less worrying.

Policymakers would also quite like to get a bit of inflation into the system and inflate their way out of the problem too. We are certainly starting to see some short-term inflationary pressures coming through, although I am sceptical about whether that is going to become a major problem. Other factors, such as technology, continue to bring a very deflationary aspect.

Do you see any signs of interest rates normalising at any point, perhaps forced up by inflation?

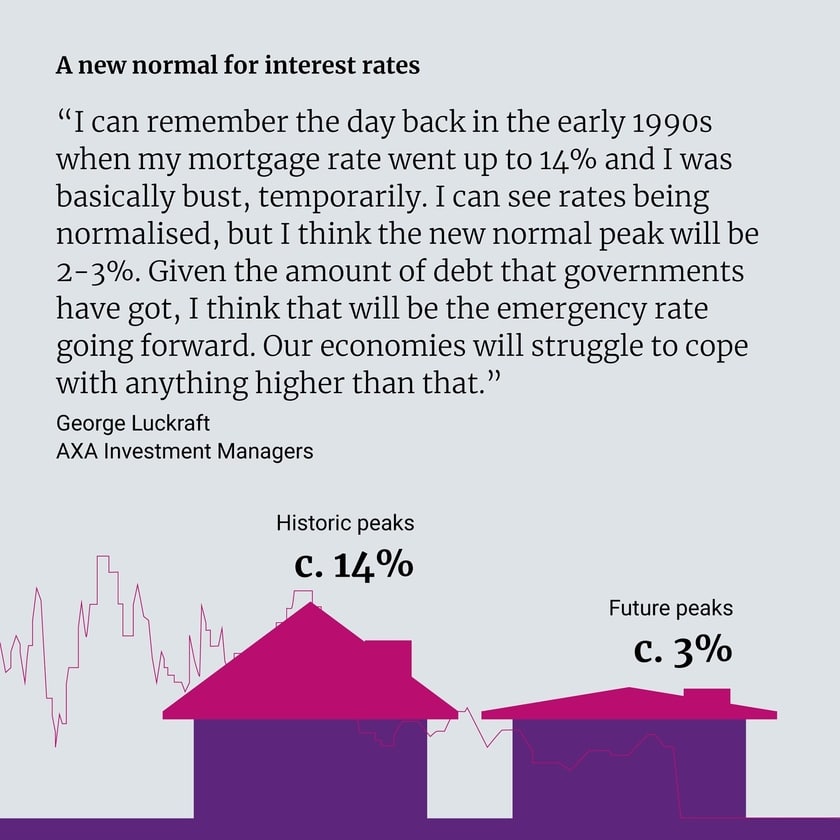

This is a situation where there is likely to be a new normal. We are all, to an extent driven by our memories. I can remember the day back in the early 1990s when my mortgage rate went up to 14% and I was basically bust. Thankfully that only lasted for about an hour – but the feeling sticks with you.

So, I can see rates being normalised, but I think the new normal peak will be 2 to 3%. Given the amount of debt that governments have got, I think 3% will be the emergency rate going forward. Our economies will struggle to cope with anything higher than that.

Does clean energy have a role to play in your portfolio?

Yes, it does. We were day one investors in a business called Greencoat UK Wind. It recently published its financial results, and it is now offsetting over a million and a half tonnes of carbon dioxide a year. Your clients’ investments helped to establish this as an asset class.

We have participated in other launches too, and it is always important that strong environmental credentials are accompanied by a robust investment thesis. Greencoat UK Wind came to the market with a 6% yield, for example. So, renewable energy has played a role in the portfolio and we aim to get the benefit of both: delivering something good for the world, while also trying to make money.

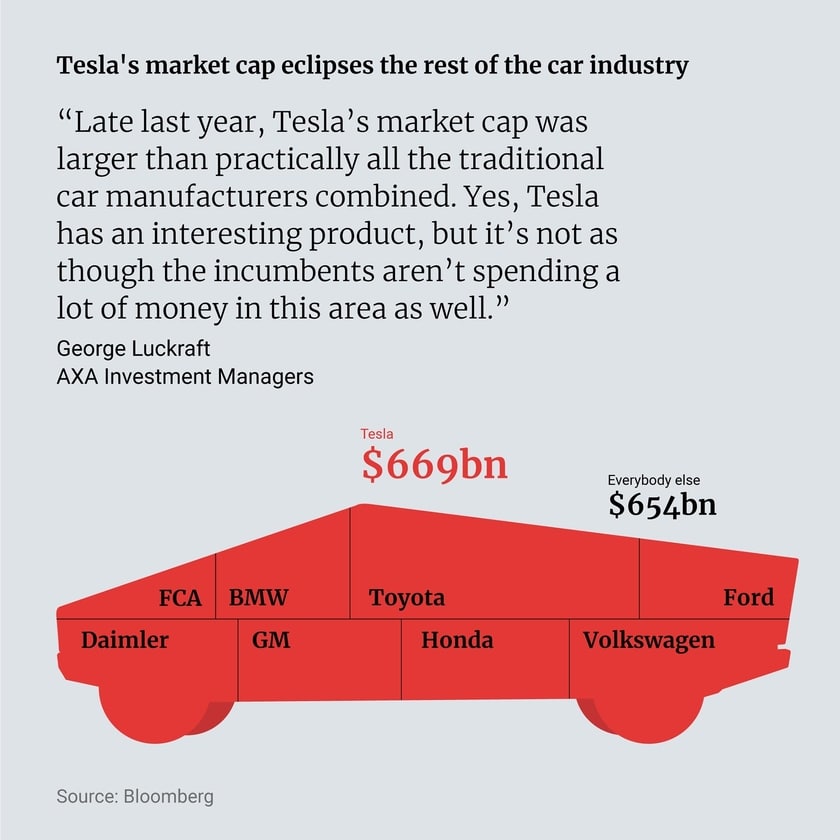

And this point requires a word of caution around valuations. Some clean energy related businesses are making tremendous progress and seeing huge expansion, but valuations can be very extreme. For example, late last year, Tesla’s market cap was larger than practically all the traditional car manufacturers combined. Yes, Tesla has an interesting product, but it’s not as though the incumbents aren’t spending a lot of money in this area as well.

How do you see Joe Biden’s presidency affecting markets?

I think the first encouraging impact is his commitment to climate change compared to his predecessor. I welcome that fully and, although it’s hard to claim that it’s beneficial for markets, the lack of it may have proved very harmful.

Meanwhile, Biden pushed hard for a large stimulus package. This is one of the reasons for the increase in bond yields. In the US, there is a direct link between bond yields and long-term mortgage rates, so the impact will likely be felt in the housing market. We’ve got record levels of activity in the US housing market currently, which has been a support to the economy. We should expect that to slow down a bit as a result of higher yields.

Elsewhere, I think corporate tax rates will go up, as they are doing here, which is a modest negative for markets. Overall, however, I don’t see Biden as being too damaging for markets.

Is it time for active management to shine again?

Yes, I think it is. The concept behind active management isn’t broken – in fact, I think it is perhaps more relevant now than it ever has been. The stock market has always been very good at producing more of what’s popular. We saw that very clearly in the internet bubble of 1999-2000, with a whole load of technology stocks coming to the market. We also saw it in the last commodity supercycle, when lots of mining companies listed, some of them making it into the FTSE 100, even though the regions in which they operated were sometimes rather esoteric. And now we are seeing it again with stocks like Trainline and Moonpig etc, which are marketing themselves as platforms which can grow very substantially.

This is something that investors need to be aware of. If you are investing in a tracker then you are effectively putting money into these stocks when they come to the market, often at expensive valuations. This is a source of market inefficiency that has perhaps become even more influential as passive investment strategies have become more popular. I think the market is more inefficient now than I have seen in my whole investing career. I love that as an aspect – it provides much more opportunity.

AXA Investment Managers is a fund manager for St. James's Place.

Where the views and opinions of our fund managers have been quoted these are not necessarily held by St. James's Place Wealth Management or other investment managers and are subject to market or economic changes. This material is not a recommendation, or intended to be relied upon as a forecast, research or advice.

The value of an investment with St. James's Place will be directly linked to the performance of the funds selected and the value may fall as well as rise. You may get back less than the amount invested.

Some of the products and investment structures documented within this article will not be available to our clients in Asia. For information on the funds that are available please get in touch.

Most recent articles