- Investing

As we wave goodbye to a tempestuous 2023, I look back to the year when “uncertainty” was the only certainty as far as markets were concerned.

Comparing notes to predictions of 2023 this time last year, the main forecasts were a certain US recession, interest rate cuts and slow to moderate (single digit) stock market growth (and “growth stocks” were the dirty words after a full “value rally”); yet 2023 saw a US economy that defied expectations of recession, interest rates higher than most remember in their careers, a comeback in tech stocks that almost no one predicted, and where good news lead to sharp falls and bad news lead to rallies.

Furthermore, the S&P500 finished on a rally of 25.6% for the year; this, after the -18.5% drop over 2022, means we are now at roughly the same level as the beginning of 20221 – this is the simple elegance of mathematics that tends to be confusing to most until one looks at the charts.

So, let’s look at some charts.

At St. James’s Place, we always talk about “decades, not years”. As I look back at 2023 in the context of the decades, three charts in particular drew my attention.

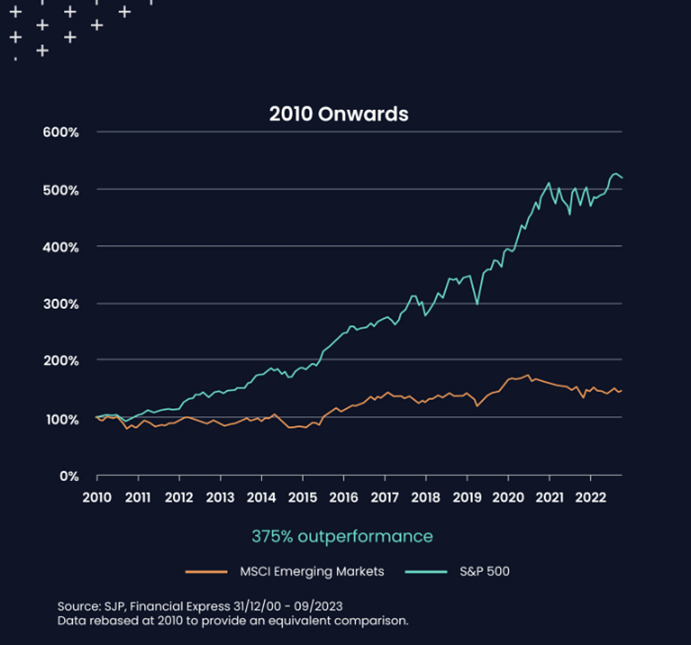

1. Emerging Markets and the S&P 500 – a game of two halves

The dominance of emerging markets from 2000 to 2010 might have led some investors to believe that this trend could last forever, but it proved to be a misconceived notion; this might feel like déjà vu with the current belief in the S&P 500. As Joe Wiggins, SJP’s Investment Research Director, explains: “One of the most dangerous investor behaviours is our propensity to extrapolate recent trends far into the future. This can tempt us to abandon the critical principles of diversification to focus on whatever has been in fashion in recent years.”

2. To diversify, or to concentrate?

Diversification is the golden free lunch in investing – isn’t it?

Global stock markets have become increasingly top-heavy, with the ten biggest stocks in the S&P 500 index making up over 30% of the market2, implying a rising degree of concentration risk. Research shows that, historically, investors passively tracking the US stock market would have lost out on returns in the years following high levels of index concentration, with more broad-based investments outperforming.

3. Clean energy potential

While many may not have leaned into sustainable investing over 2022-23, no doubt not many will have missed the explosive growth of electric vehicles (“EV”) in recent years. It is believed that more than 23 countries have reached the 5% tipping point for EV sales over 20233 – the threshold that signals the start of mass adoption and the decline of the direct substitute for traditional oil-based fuel. According to the International Energy Agency (“IEA”), around 5% of current oil demand will have been wiped out by 20304.

It’s not just EVs. The tripling of renewables by 2030 pledged at the recent COP28, along with the massive investments required to meet agreed goals, should provide significant opportunities in the clean energy space from renewables to energy efficiency, electrification and hydrogen.

The investment landscape can appear to be a rugged terrain with many obstacles and dilemmas. However, the probability of success increases the longer our investment horizon. It is therefore important to remember and focus on what we can control. By staying invested in the markets and riding out the storms along the way, there is a better chance of success when it comes to achieving one’s long-term investment goals.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds selected and may fall as well as rise. You may get back less than the amount invested.

Please note that past performance is not an indicative of future performance.

© S&P Dow Jones LLC 2024. All rights reserved.

Sources

1FE Analytics

2FE Analytics

3Bloomberg, August 2023, “Electric Cars Pass a Crucial Tipping Point in 23 Countries.”

4International Energy Agency, “Global EV Outlook 2023”

Most recent articles